Page updated – September 2024

Did you know legacy benefits are changing? It could impact when and how you receive your payments.

What is it?

Universal Credit is a benefit payment from the DWP (Department of Work and Pensions) for people aged over 18 but under state pension age, who are on a low income or out of work.

It’s a monthly payment to help you with living costs, including support with the cost of housing, children and childcare, and financial support for people with disabilities, carers and people too ill to work.

New claimants or anyone who’s had a significant change in circumstances will have already been changed over to Universal Credit. However, there are some people who are still claiming legacy benefits. The DWP is aiming for all people who claim legacy benefits to migrate over to Universal Credit via managed migration.

What are legacy benefits?

- Income Support

- Employment and Support Allowance

- Working Tax Credits

- Child Tax Credits

- Jobseekers Allowance

- Housing Benefit

What is managed migration?

Managed migration is where people getting legacy benefits will have their claims transferred to Universal Credit via a managed process. Managed migration is expected to be complete by the end of 2025 for most people.

What to expect?

If you get any of the legacy benefits above then you’ll receive a letter from the DWP explaining that you need to migrate over to Universal Credit, they’ll also tell you the deadline for doing this and how you can make a new claim.

It’s important that you only act once you’ve been notified by letter by the DWP as you may be entitled to protection of your benefits.

Please see the information below if you need any further support or advice:

- DWP Universal Credit Migration National Helpline – 0800 169 0328

- gov.uk

- citizensadvice.org.uk

- moneyhelper.org.uk

If you do make a new claim for Universal Credit then please ensure you enter your landlords details as Livv Housing Group.

If you still require further support and advice then please contact us on 0151 290 7000 or freephone 0800 561 0007 and ask to speak to the Financial Support Team.

-

Universal Credit prepares you for the world of work in which most workers are paid monthly. It also encourages you to take responsibility for your own finances. Universal Credit is paid in a single monthly sum.

Alternative Payment Arrangements (APAs) are for people who can’t manage single monthly payment and there might be a financial impact on you or your family.

The following APAs are available to help you if you need more support:

- paying rent directly to your landlord, known as a ‘managed payment’

- more frequent payments: twice a month – or in exceptional circumstances 4 times a month – instead of once a month

- split payment of an award between partners in a couple

APAs may be considered at any point during the Universal Credit claim. They may be identified from the start by a work coach, case manager, your landlord or at any time during the claim, it might that you’re struggling with the single monthly payment. An APA can be applied for directly by you via your Journal, your work coach at the Job Centre or your landlord.

For example:

- are you managing to pay your bills on time, particularly your rent, and have you fallen into arrears in the past, or are you currently in arrears?

- do they think you’ll be able to manage a monthly budget, looking at what’s going in and out of your bank account?

- if your part of a couple, are you used to managing your money together and do you think you’ll be able to manage a single Universal Credit payment?

- If you’re needing extra help?

The APA takes into account the following:

- addiction problems

- rent arrears

- mental health issues

- learning difficulties

- previously homeless

If you feel that you meet the criteria and would benefit from an alternative payment arrangement then please apply directly via your Universal Credit Journal, speak to your work coach or speak to our Financial Support Team.

Further information regarding alternative payment arrangements can be found at:

-

Universal Credit will include any housing costs you’re entitled to, but it doesn’t include financial support for Council Tax.

You’ll need to make a new claim for Council Tax Support separately from your Universal Credit Claim to your local council.

You can apply if you own your home, rent, are unemployed or working.

What you get depends on:

- where you live – each council runs its own scheme

- your circumstances (for example income, number of children, benefits, residency status)

- your household income – this includes savings, pensions and your partner’s income

- if your children live with you

- if other adults live with you

Please be aware that if you’ve recently been sent a Universal Credit migration notice and you previously claimed Housing Benefit and Council Tax Support together, then you don’t need to reapply for Council Tax Support.

-

If you don’t have enough to live on while you wait for your first payment you may be able to get an advance of your first Universal Credit payment.

You can apply for an advance payment of your Universal Credit if you’re struggling while you wait for your first payment, for example, if you can’t afford to pay your rent or buy food.

You’ll need to pay back your advance a bit at a time from your future Universal Credit payments, or by other means if you no longer get Universal Credit, for example, from your wages or other benefit you may be getting.

You can apply for a Universal Credit advance:

- before you get your first payment

- if you’re already being paid Universal Credit and have told us of a change in your circumstances that means you’ll be paid more Universal Credit but have not yet been paid the increased amount

To apply for a Universal Credit advance you can:

- speak to your Jobcentre Plus work coach

- apply through your online account (Journal)

- call the Universal Credit helpline

Please be aware that if you apply for an advance you may be given your housing costs too which you will need to pay to your landlord to cover your rent.

Further information regarding Universal Credit Advance Payments can be found at:

-

To get Universal Credit payments, you’ll need to accept an agreement called a ‘claimant commitment’.

This is a record of what you agree to do to:

- prepare for and look for work

- increase your earnings, if you’re already working.

If you live with your partner, you’ll both have to claim Universal Credit. You’ll each have your own claimant commitment.

You must do everything you agree to in your commitment or your payment could be reduced or stopped. This is called a sanction.

You’ll have a meeting to discuss your claimant commitment, usually at the jobcentre. In this meeting you’ll discuss your circumstances and talk about anything that could make it hard for you to do what’s in your agreement. For example, if you have a mental health condition, or if you care for someone.

Your Universal Credit commitment is looked at regularly and will change if your circumstances change. For example, if you get ill, your partner starts a job or you have a child.

You may need to attend regular appointments. These are usually in the jobcentre, but could also be by phone.

If you miss an appointment, you’ll need to provide a good reason for not going. If your reason is not accepted, you could get a sanction and your Universal Credit payment will be reduced.

Further information regarding Universal Credit claimant commitment can be found at:

-

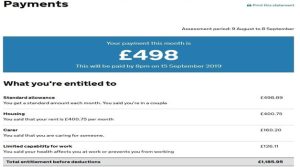

Universal Credit is made up of ‘elements’– Standard/Couple Allowance, Child Element, Childcare Costs, Housing Costs, Carer’s Element, and elements depending upon your Capability for Work.

All these elements are added together to work out your ‘maximum UC award’ (total amount you’ll get). If you had no other wages, pensions, other benefits coming in, then this is how much UC you’d be entitled to.

You can find how much UC you have been paid in the ‘Payments’ screen of your Journal.

Example pictured below:

Your whole rent figure may not be included in the calculation if you are affected by the benefit cap, the bedroom tax, or have a non-dependent deduction.

Another reason may be that you’ve not updated your rent charge which is applied every April. In this case it is best to update your journal as soon as possible.

If your full rent figure is not included in your calculation, it’s important to find out why.

The DWP may put a note under your housing costs, to tell you why they are not paying your full housing costs- such as the bedroom tax, or a ‘housing contribution’ for another adult in the house.

Rent Increases

Your rent will go up at the start of the financial year which is in April. You’ll be told of any rent increase and advised on what to do. Please make sure you update your Universal Credit Journal on time and from the correct rent increase start date. If you do make a new claim for Universal Credit then please ensure you enter your landlords details as Livv Housing Group.

Further information regarding Universal Credit payment breakdown can be found at:

-

If you need support on any of your Universal Credit application, what to do, or how to apply there are some useful websites and phone numbers below.

DWP UC Migration National Helpline on 0800 169 0328

Citizen’s Advice Help to Claim (8am-6pm) on 0800 144 8444

If you still require further support and advice then please make contact with Livv Housing Group on 0151 290 7000 or freephone 0800 561 0007 and ask to speak to the Financial Support Team.